- The Renegades Newsletter

- Posts

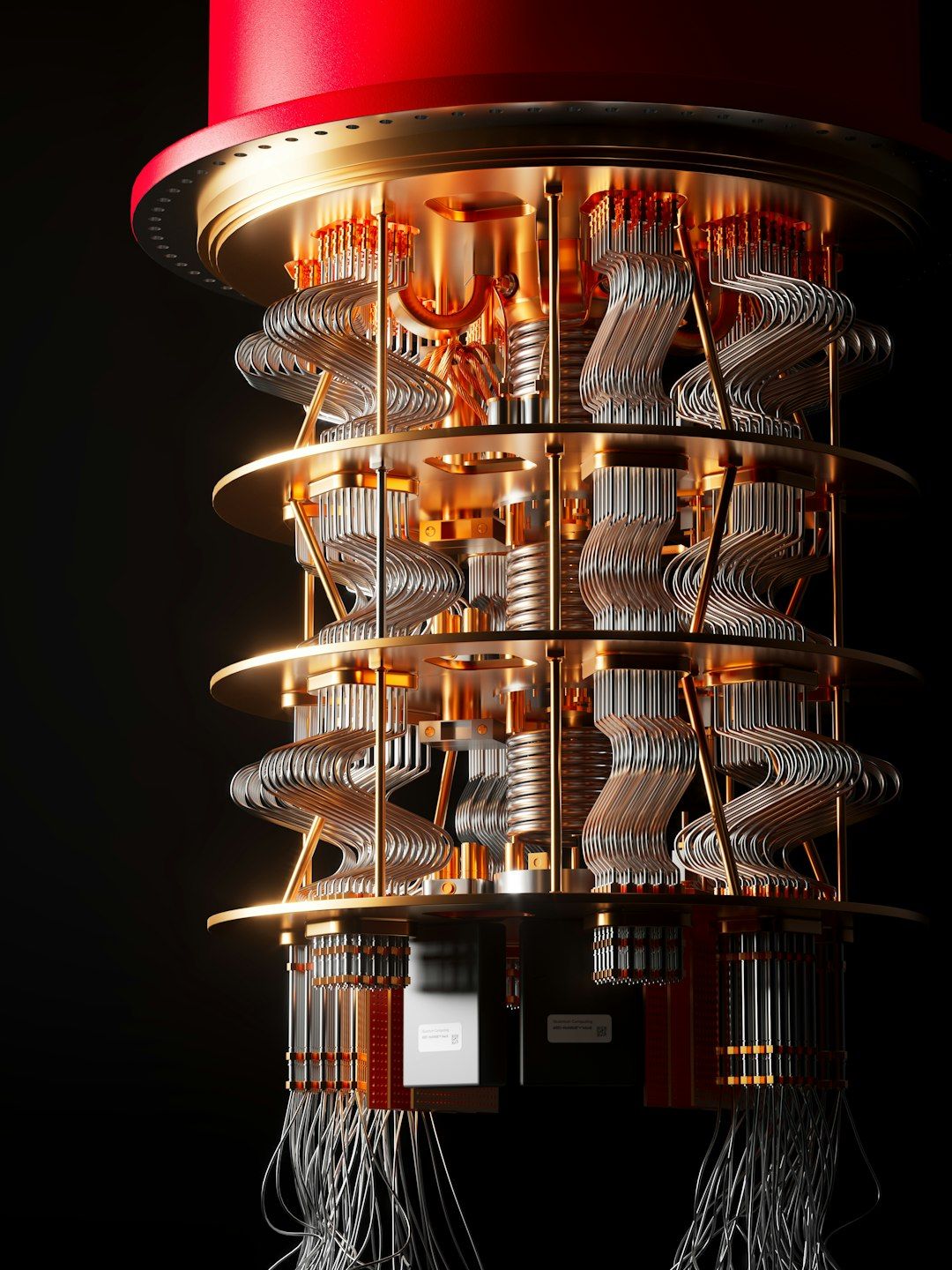

- Bitcoin's Biggest Threat. The Quantum Computer That Could Kill Crypto

Bitcoin's Biggest Threat. The Quantum Computer That Could Kill Crypto

If quantum machines reach 3000 qubits, Bitcoin's security will crumble unless it adapts fast.

For years, Bitcoin has been praised as unbreakable. But no security lasts forever. A technological leap in quantum computing could undermine the cryptographic foundation of the world’s most valuable cryptocurrency unless the industry adapts in time.

Cryptocurrencies like Bitcoin were designed to resist traditional attacks, both technical and political. They’ve survived regulatory crackdowns, exchange collapses, and brutal market cycles. But the threat posed by quantum computing is different: it’s a fundamental challenge to the math that underpins the entire system.

While most quantum computers today are experimental and error prone, researchers say that if quantum technology reaches around 3000 stable, error-corrected qubits, it could render Bitcoin’s current cryptographic safeguards obsolete.

The Heart of Bitcoin’s Security

Bitcoin relies on two core cryptographic primitives:

ECDSA Signatures

Ensures only the holder of a private key can authorize spending.

Protects ownership of coins.

2. SHA-256 Hashing

Powers the proof-of-work mining process.

Makes adding fraudulent blocks prohibitively costly.

These systems are nearly unbreakable for classical computers. Cracking them would take longer than the age of the universe. But quantum computers aren’t bound by those same limits.

The Quantum Computing Threat

Quantum computers exploit the principles of quantum mechanics to solve problems far faster than classical machines.

Two quantum algorithms are especially relevant:

Shor’s Algorithm

Can efficiently factor large numbers and solve discrete logarithm problems.

Breaks ECDSA, allowing recovery of a private key from its public key in minutes.

Any Bitcoin address that has ever exposed its public key becomes vulnerable.

2. Grover’s Algorithm

Offers a quadratic speedup for brute-force searches.

Reduces SHA-256 security from 256 bits to around 128 bits.

Makes Bitcoin mining far more efficient for quantum equipped attackers.

Let’s create a Realistic Attack Scenario

Imagine a future say 2032 in which a nation state or well funded tech firm develops a 3000 qubit quantum computer.

Here’s how an attack might play out:

Targeting Exposed Addresses

Bitcoin users who have reused addresses reveal their public keys on-chain.

An attacker uses Shor’s algorithm to recover private keys quickly.

They monitor the network for such transactions and replace them with their own, stealing funds mid-flight.

2. Quantum-Accelerated Mining

Using Grover’s algorithm, the attacker solves proof-of-work problems much faster.

They can outcompete honest miners for block rewards.

In the worst case, they could mount a 51% attack, reorganizing the blockchain to censor transactions or double-spend.

This isn’t science fiction it’s a realistic, if long term, threat that could severely damage trust in Bitcoin’s decentralized model.

Then How Bitcoin Can Defend Itself

Despite the alarming possibilities, Bitcoin isn’t helpless. Developers and researchers have been studying quantum resistance for years.

Stop Address Reuse

Bitcoin addresses shouldn't be reused.

Reusing addresses exposes public keys to attackers.

Best practice: generate a new address for each transaction.

2. Adopt Post Quantum Signatures

Cryptographers have developed signature schemes resistant to quantum attacks (e.g., SPHINCS+, XMSS).

Integrating these into Bitcoin will require upgrades to the protocol.

Such changes can be proposed as soft forks (backward compatible) or hard forks (mandatory).

3. Mining Difficulty Adjustments

Bitcoin’s mining difficulty retargets every two weeks.

While a quantum miner could profit hugely at first, the network would eventually compensate.

But this wouldn’t stop double spending attacks on signature vulnerabilities.

Here’s another question, How Close Are We?

Quantum computing is still in its early stages.

Current machines have around 100–1000 noisy physical qubits with high error rates.

To get 3000 logical qubits (error-corrected, reliable qubits), we may need millions of physical qubits.

Realistic timelines for that level of scale range from the 2030s to 2040s.

However, progress is steady and well funded. IBM, Google, and China’s government labs are all racing to build scalable quantum systems. It’s not a question of if, but when.

Implications for Investors and the Crypto Industry

The possibility of quantum attacks isn’t simply an academic concern.

For Bitcoin Holders

Address hygiene matters. Don’t reuse addresses.

Be prepared to migrate to quantum safe wallets once they’re available.

For Developers

Work on post quantum signature integration now.

Prepare for the complexity of coordinating a network-wide upgrade.

For the Industry

Exchanges, custodians, and hardware wallet makers need to support quantum safe standards.

Regulatory bodies may demand quantum resilience for consumer protection.

To sum it up

Bitcoin has weathered many existential threats. But quantum computing is arguably the most fundamental challenge it has ever faced.

If the industry prepares in advance, with good address hygiene and adoption of quantum resistant cryptography, Bitcoin can survive and even thrive in the quantum era.

If it ignores the threat, the consequences could be catastrophic; theft on an unprecedented scale, loss of user trust, and potentially the death of the network as we know it.

The quantum reckoning is coming. It’s time for the crypto world to get ready.

References:

Shor, P.W. (1994). Algorithms for Quantum Computation: Discrete Logarithms and Factoring.

Grover, L.K. (1996). A Fast Quantum Mechanical Algorithm for Database Search.

NIST Post-Quantum Cryptography Standardization

Bitcoin.org Developer Guide

IBM Quantum Roadmap

This article is also available on Medium for those who prefer reading there. |

Want more in-depth crypto insights? Subscribe to our free newsletter on Beehiiv for exclusive analysis, alpha, and updates—delivered straight to your inbox! |

Want to launch your own newsletter? Use my referral link to get: |

30-day free trial (no credit card needed)

20% off your first 3 months after trial!

Perfect for creators ready to monetize their audience. Start free now → |

Reply